Have you ever found yourself juggling between multiple finance apps to manage your spending, saving, and investing? Well, let me introduce you to Revolut: Spend, Save, Trade. This app is like that all-in-one gadget you never knew you needed until you had it. Trust me, it’s a game-changer.

What’s the Buzz About?

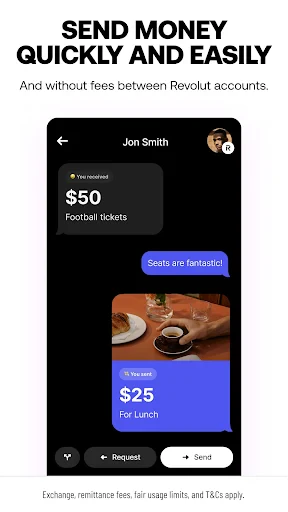

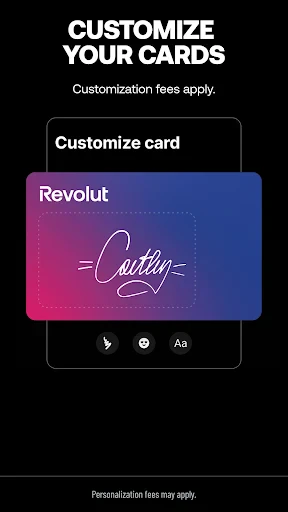

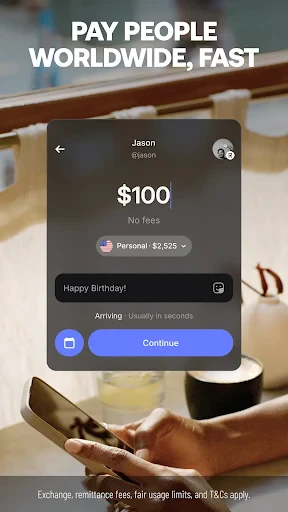

So, what makes Revolut tick? The app brings a whirlwind of features right to your fingertips. Imagine having a bank in your pocket, minus the long queues and tedious paperwork. From opening an account in minutes to making instant global payments, it’s all about speed and convenience. And hey, who doesn’t love that?

Spending Made Simple

One of the first things I noticed about Revolut is how it simplifies spending. You can hold and exchange 30+ currencies with no hidden fees. Plus, the app offers real-time exchange rates, so you’re always in the loop. I mean, why pay more when you can pay smart, right?

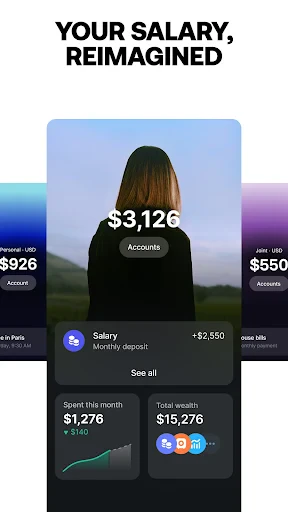

Savings Goals? Check!

Saving money is hard, but Revolut makes it easier. It’s like having a personal finance coach in your pocket. You can set up automated savings, round up spare change, and even create personalized vaults to stash away cash for that dream vacation or new gadget. It’s like a digital piggy bank that’s always there to encourage you.

Trade Like a Pro

If you’re into trading, Revolut offers commission-free stock trading. Yes, you heard that right! It’s perfect for beginners dipping their toes into the stock market or seasoned traders looking for a hassle-free experience. Plus, with the ability to buy fractional shares, you don’t need to break the bank to invest in your favorite companies.

Oh, and did I mention the cryptocurrency trading? Whether you’re a Bitcoin enthusiast or just curious, Revolut has got you covered. It’s all about giving you the power to diversify your investments.

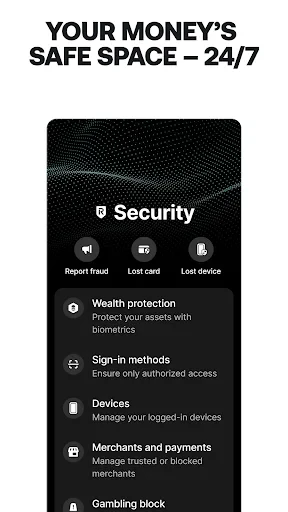

Security You Can Trust

Now, let’s talk about something crucial — security. With Revolut, your money is in safe hands. The app uses advanced security features like two-factor authentication and instant notifications for every transaction. It’s like having a security guard for your finances, ensuring everything is as it should be.

And if you ever lose your card, you can instantly freeze it through the app. No more frantic calls to the bank, which is a relief, especially when you’re in a pinch.

The Verdict

So, is Revolut: Spend, Save, Trade worth it? In my book, absolutely. It’s a versatile app that caters to all your financial needs with ease and efficiency. Whether you’re saving for a rainy day, investing in stocks, or just managing daily expenses, Revolut is like that trusty sidekick that’s always got your back. Give it a whirl and see for yourself; you might just wonder how you ever managed without it.