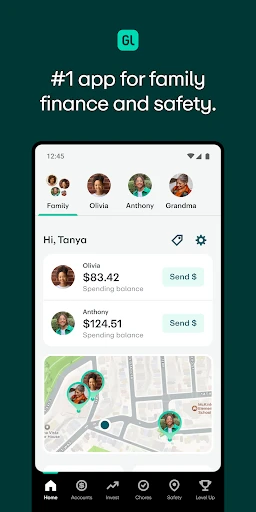

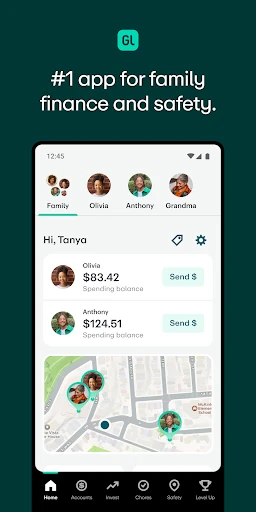

Ever thought about how cool it would be if your kids could manage their own money, but with a little supervision? Well, that's where Greenlight Kids & Teen Banking comes in. It's like handing over a mini bank to your children but with parental controls that let you sit back without breaking a sweat. I decided to give it a whirl to see if it’s the real deal or just another app with fancy promises.

The Setup: Easy Peasy Lemon Squeezy

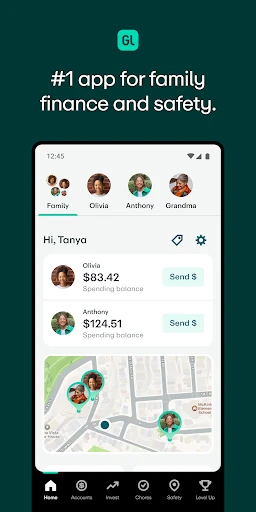

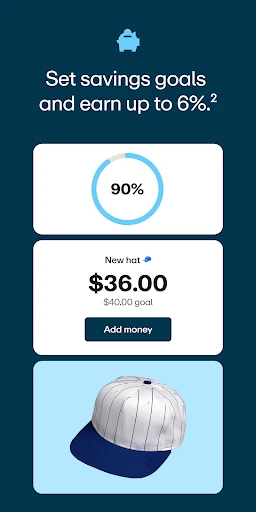

Getting started with Greenlight Kids & Teen Banking is as easy as pie. I signed up, and within a few minutes, I was setting up accounts for my two kiddos. The app guides you every step of the way, making sure you don’t miss a beat. Plus, the interface is bright and colorful—perfect for kids, right? It felt like a breeze setting up their savings goals and even assigning chores for allowance. Talk about modern-day parenting!

Features Galore

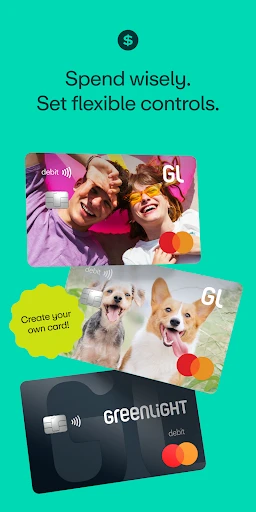

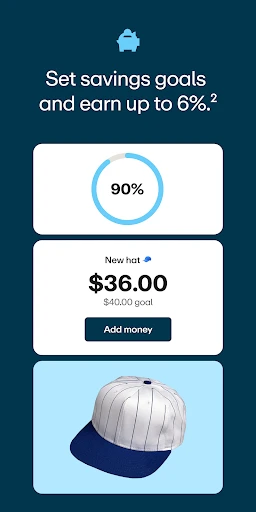

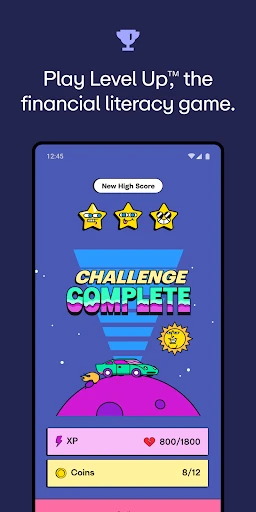

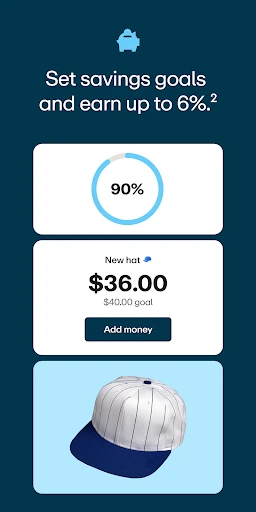

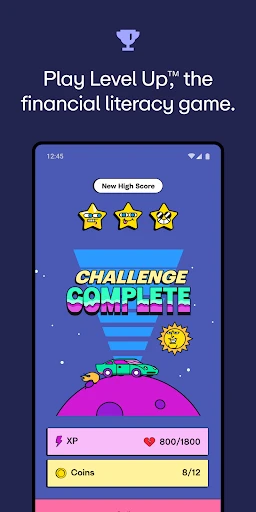

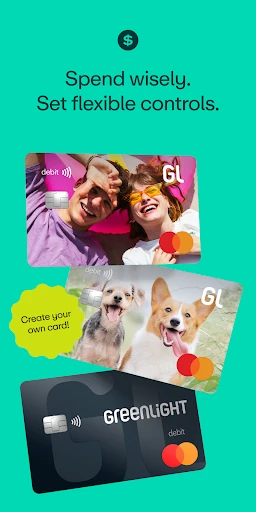

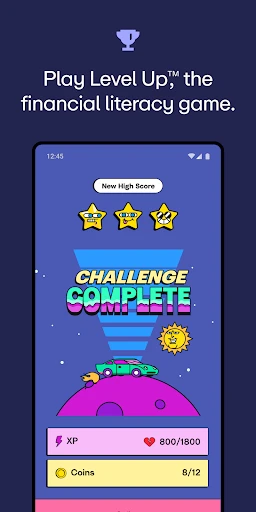

This app isn’t just about basic banking. Oh no, it’s packed with features! From setting savings goals to tracking spending, your kids get to learn about money management in a fun and engaging way. The app even allows you to set up chore lists, and kids can earn their allowance by checking off completed tasks. I mean, who knew chores could be this rewarding?

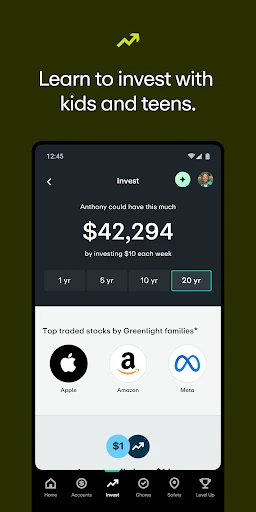

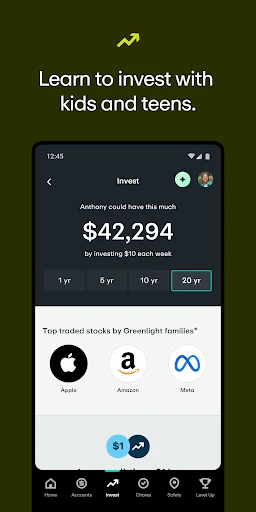

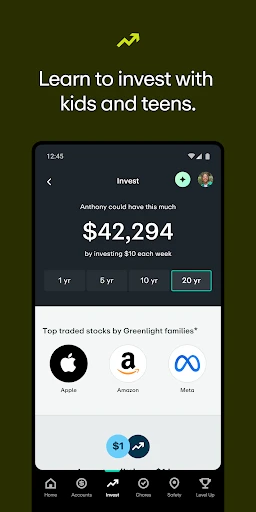

There's also the option to invest, which is pretty sweet. Your teens can dip their toes into the world of investing with a selection of funds. It's like giving them a head start on their financial literacy journey. And the best part? You have full control and can monitor every transaction. So, no surprise candy store sprees!

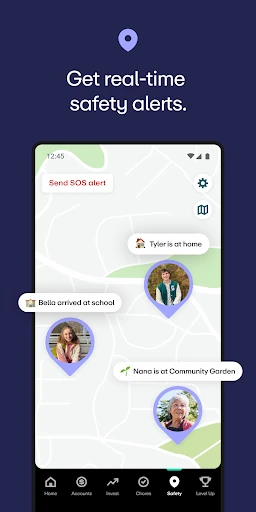

Security: Keeping It Safe

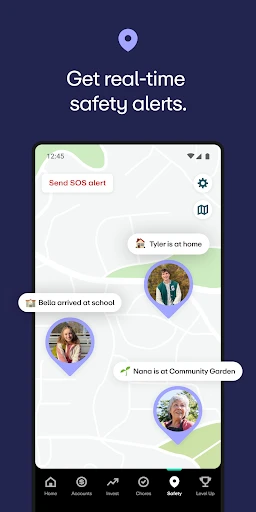

Let’s face it—security is a big deal, especially when it comes to your kids. The app uses bank-level encryption, so I felt secure knowing their financial data is locked tight. Plus, there are instant notifications for every transaction, allowing me to keep tabs on their spending in real-time. It’s like having an extra pair of eyes!

Wrapping It Up: Is It Worth It?

So, after diving deep into the world of Greenlight Kids & Teen Banking, would I recommend it? Absolutely! It’s a fantastic tool for teaching kids the value of money, savings, and even investing. The interactive elements keep them engaged, and the parental controls keep things in check. If you’re looking for a way to introduce your kids to the financial world without all the stress, this app is definitely worth a try. It’s modern parenting with a digital twist, and I’m all here for it!