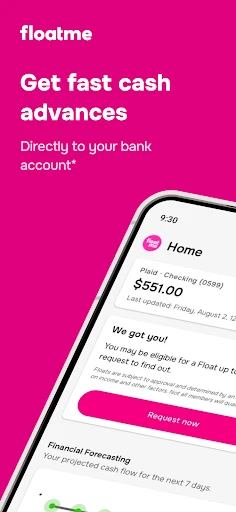

Have you ever been in that sticky situation where payday feels like a lifetime away, but you need a little cash boost just to get you through the week? If your answer is yes, you might want to check out FloatMe: Budget & Cash Advance. Let me give you the lowdown on how this app can potentially be your financial lifesaver.

FloatMe: A Lifeline for Your Wallet

FloatMe is an app designed to help you manage your budget more efficiently while providing a cash advance option when you're in a pinch. This isn't just about getting money fast; it's about helping you avoid those pesky overdraft fees and giving you a little breathing room until your next paycheck. And trust me, with overdraft fees feeling like they're constantly looming, every little bit helps.

Getting Started with FloatMe

First things first, signing up for FloatMe is a breeze. After downloading the app from your respective app store, setting up your account is straightforward. You’ll connect your bank account, which allows the app to analyze your spending habits. This might sound a bit intrusive, but it's all about helping you keep track of where your money is going. Plus, it's entirely secure, so there's no need to worry about your data being mishandled.

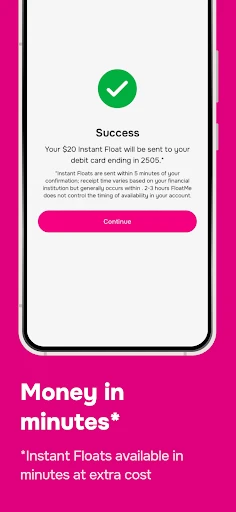

Once you’re all set up, you can request a cash advance of up to $50. Now, I know what you're thinking—it’s not going to fund a shopping spree, but it's just enough to tide you over until payday. Think of it as borrowing from a friend without the awkwardness.

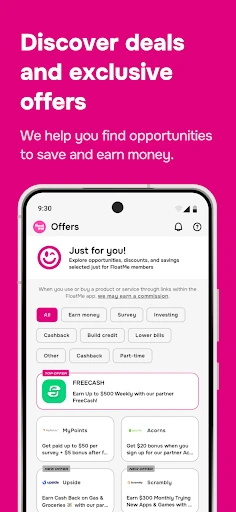

Features You’ll Love

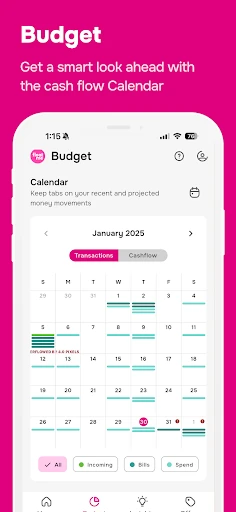

One of the standout features of FloatMe is its budget tracker. It's not just about getting a cash advance; it's about putting you back in control of your finances. The app provides insights into your spending patterns, highlighting areas where you might be splurging a little too much. It’s like having a mini financial advisor in your pocket, nudging you towards better money habits.

Another nifty feature is the overdraft alert. The app sends notifications when you're close to dipping into the red, allowing you to take action before those bank fees hit. This proactive approach can save you a decent chunk of change in the long run.

The Catch?

Like most things in life, there’s a bit of a catch. FloatMe requires a $1.99 monthly subscription fee. While this isn't bank-breaking, it’s something to consider if every penny counts. However, if you think about the potential savings on overdraft fees, it might just be worth it.

Also, the cash advance feature is limited to $50, which might not suit everyone’s needs, especially if you’re dealing with larger financial hiccups. But if you're looking for a bit of quick relief, it does the job nicely.

Final Thoughts

All in all, FloatMe: Budget & Cash Advance is a handy tool for those who find themselves occasionally short on cash before payday. It’s an app that not only offers a quick financial fix but also helps you manage your spending more effectively. While the monthly fee and cash advance limit might be a downside for some, the benefits of avoiding overdraft fees and gaining better financial insight could outweigh the costs.

So, if you’re looking for a little extra financial cushion and some guidance in budgeting, FloatMe might just be the app you need. Give it a shot and see if it can help you float your way to better financial health!